At Hope Street Capital, we believe great businesses are built on trust, alignment, and long-term vision. As close friends and committed operators, we take a hands-on, collaborative approach to acquiring and growing one exceptional business. Our goal is simple: partner with a founder to build enduring value — together.

A Clear Path to Building Lasting Value

What We’re Looking For

-

People

· Owner values their legacy and employees

· An existing team that manages day-to-day operations

· Key personnel will stay after the company transitions

-

Business

· Healthcare, B2B & Consumer Services, Vertical SaaS

· Outstanding customer service and employees

· Differentiated product, service, or experience

· Low customer churn

-

Financials

· ~$1-10M pre-tax annual profit or at least $3-6M ARR for subscription software

· History of profitable growth and high ratio of recurring sales

· 15%+ net profit margin

· 3+ years of tax returns

· Low customer concentration (top 5 customers are less than 1/3 sales)

A Collaborative Approach to Ownership Transition

We understand that selling your business is a significant and personal decision. That's why our approach is rooted in listening first, communicating clearly, and building trust every step of the way. We will commit to:

Getting to Know You

Your company's story, values, and the people behind it matter. We take the time to learn what's made your business what it is today so that we can honor that foundation.

Clarity Every Step of the Way

From first conversation to final agreement, we keep you in the loop and never leave you guessing. We believe transparency builds trust.

Respecting Your Team

Your employees are central to the company's success. We're committed to supporting and valuing them through the transition and beyond.

Fair Negotiation

Our goal is to create a win-win outcome where you feel heard and respected. We don't rush or pressure, we lead with empathy, fairness, and respect.

Focusing on the Future

We aim to grow the company with care. Preserving your values while helping it thrive for the next generation is our priority.

The Process

Exploration (15 - 30 days)

Explore the opportunity and see if it is a good fit for both parties

We provide the 1st information request list and preliminary fair market value range

We submit an expression of interest to you

You decide if we move forward

Letter of Intent (30 - 60 days)

We provide the 2nd information request list

We submit to you a letter of intent with key agreed upon deal terms clearly outlined

You decide if we move forward

Diligence (60 - 180 days)

We provide the 3rd and final major information request list

We complete our due diligence

Finalize purchase documents

Closed Transaction

We sign documents and you are paid

You transition at an agreed upon pace that works for both you and us

We begin operating and investing in the business for the long term

| Hope Street | Private Equity | Strategic Buyer | |

|---|---|---|---|

| Post-transaction Commitment | Your company will be the full-time focus | Your company will become one of many portfolio companies | Your company will become one of many business units |

| Goal | Grow the business, honor your legacy | Maximize returns for investors | Cut costs and achieve synergies |

| Company Legacy | Your core values live on, your people remain a top priority | Cost cutting could imply changes to suppliers, customers, and employees | Integration with larger companies will mean a big shift to your employees, suppliers, and customers |

| Employee’s Future | Will be part of the company’s future success | High risk of job cuts | High risk of job cuts |

| Team | Experienced, humble, and hungry entrepreneurs and investors | Professional investors who typically outsource operations | Varies |

| Deal Terms | Flexible, reasonable, and tailored to the owner and what is best for the company’s growth | Inflexible, uses standard terms established by the fund. Will usually be higher than our offer | The least flexible, tailored towards the needs of the acquiring company |

| Operating Time Horizon | Long-term | < 5 years | Uncertain |

The Hope Street Capital Difference

About Us

Hope Street Capital’s partnership is built on a decade-long friendship forged through shared experiences, mutual trust, and a deep understanding of each other’s values and strengths. Growing up just outside Chicago, Chris and Miki both found their way to Brown University, where their bond was cemented through countless battles on the basketball court as teammates on the Brown Basketball team. Those high-pressure moments on the court taught them how to work together under stress, motivating and pushing each other to perform at their best. These shared experiences gave them invaluable insight into what drives one another and how to bring out the best in their partnership.

With a deep appreciation for what it takes to succeed as a team, their professional paths and mutual passion for building businesses led them to launch Hope Street Capital. The search fund is named in tribute to Hope Street, the location of the Brown University gym where their friendship began and where the resilience, hard work, and determination that define their relationship were first forged on the basketball court.

-

Co-FounderPrior to founding Hope Street Capital, Chris was an investment professional at Shore Capital Partners, where he supported healthcare and business services portfolio companies. He played a key role in executing 25+ strategic acquisitions, supported capital raising efforts across multiple portfolio companies, and partnered with management teams to drive long-term value creation. Chris began his career at healthcare consulting firm named Kaufman Hall, where he advised hospitals and health systems on growth strategy and financial planning. Raised a few miles north of Chicago, Illinois, Chris holds an MBA from the Kellogg School of Management and a BA from Brown University, where he was a two-year captain of the men’s basketball team.

-

Co-FounderPrior to founding Hope Street Capital, Miki was a Senior Associate at Kingfish Group, where he led co-investment and commercial diligence engagements alongside leading private equity firms. His work included sourcing and evaluating investments in business services and technology, authoring investor materials, and managing teams across multiple projects. Earlier in his career, Miki launched and grew the healthcare vertical at Tegus, contributing to the company’s rapid ARR growth. He began in professional sports as a player development associate for the Sacramento Kings. Raised a few miles west of Chicago, Illinois, Miki earned his BA from Brown University and an MS in Business Analytics from DePaul, graduating first in his class.

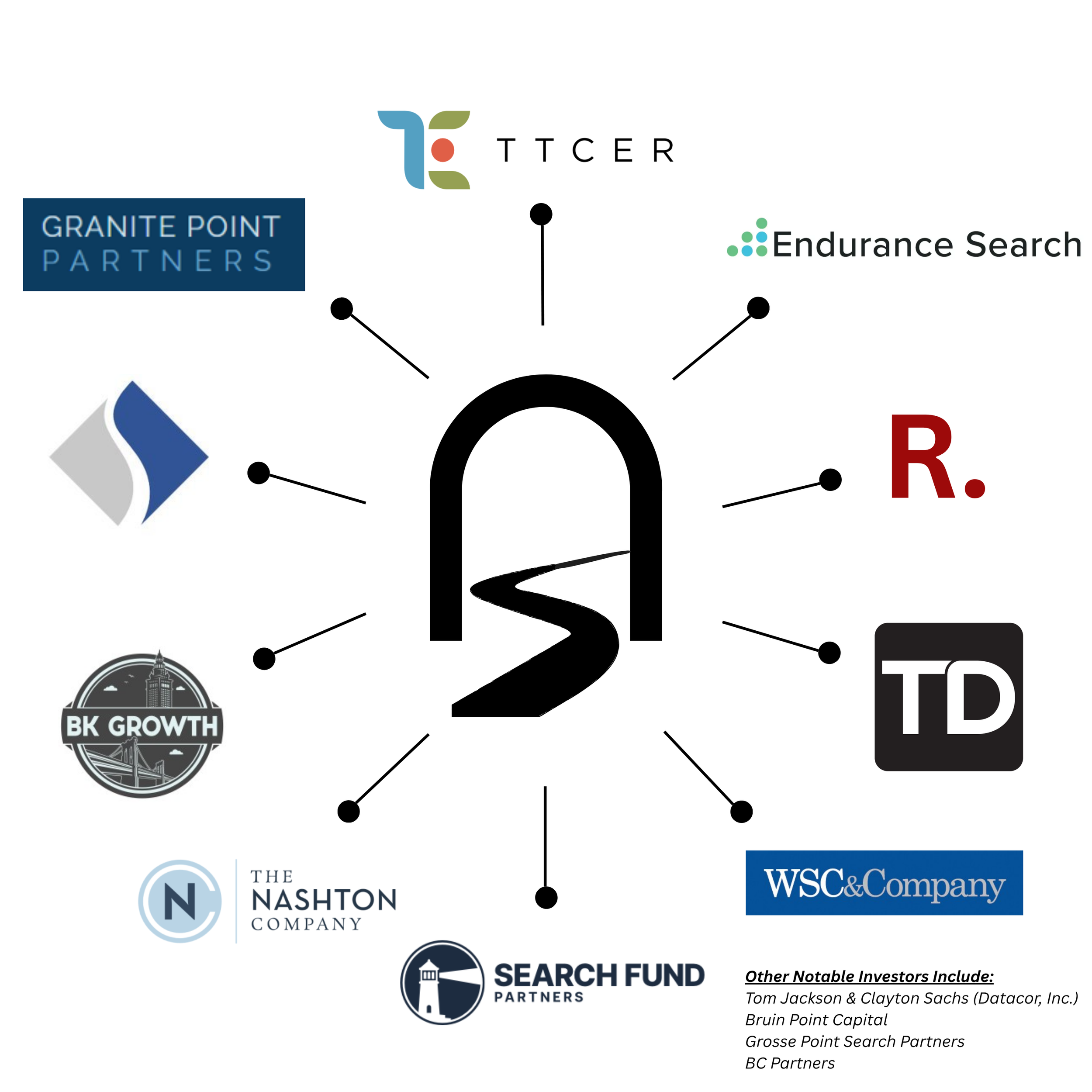

Investor Team

Hope Street Capital is backed by a group of seasoned investors, operators, and entrepreneurs with a proven track record of scaling exceptional businesses. Collectively, they bring decades of experience in the search fund and private investing space, having led numerous successful acquisitions and driven sustained growth across various industries. These partners provide Chris and Miki with the capital, mentorship, and resources needed to successfully navigate the search, acquisition, and operational journey.

Contact us.

csullivan@hope-st-capital.com

M: (847) 922-3852

mljuboja@hope-st-capital.com

M: (708) 528-5213

Address:

1165 N Clark St, Suite 700, Chicago, IL 60610